Dionte Berry

Editor-in-Chief

[email protected]

As tax season is well underway, Murray State accounting and finance students are offering tax preparation services to the local community.

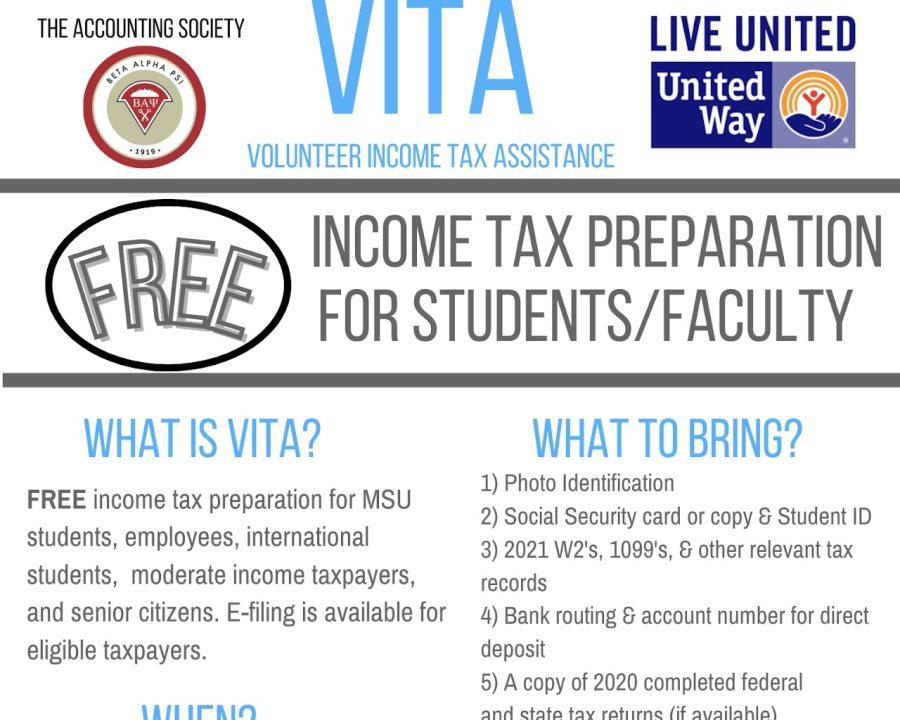

Through the IRS sponsored Volunteer Income Tax Assistance (VITA) program not only is the service provided for free, but it gives student volunteers key experience in their job field.

Denise O’Shaughnessy, assistant accounting professor and the director of the Murray State VITA program since 2016, oversees and guides students as they provide tax services.

“This is our 46th year offering this VITA program for both our students to be able to get real-life work experience and to help out our community, our students, our faculty and our international students,” O’Shaughnessy said.

As Director of Murray State’s VITA program, O’Shaughnessy is responsible for training the student volunteers and passing on her knowledge of accounting laws.

“Since I teach about taxes here at Murray State, I’m able to stay up with all the current laws and changes and all those things, so that I’m able to pass that on to my students I train,” O’Shaughnessy said. “They have to go through a two-day training session, they have to take an ethics certification and they have to pass certification for taxes they want to prepare.”

O’Shaughnessy led 40 student volunteers through training, and they worked their first session on Friday, Feb. 25. O’Shaughnessy and her student volunteers worked with around 30 clients.

O’Shaughnessy runs the program as if it was an actual tax preparation office. Clients are greeted and interviewed by students before they go on to prepare their tax returns. She said the experiences students have had at VITA has helped them when working jobs and internships.

“It’s scary to start a real job, so VITA is a safe place,” O’Shaughnessy said. “I’m there and I don’t leave them, and so they get that confidence to go out into the real world.”

Martha Briones is a senior accounting major and site coordinator for Murray State’s VITA program. In this position, Briones is responsible for helping O’Shaughnessy by reviewing volunteer-prepared tax returns, coordinating sessions and guiding other tax preparers.

“In my role as a site coordinator, I gain management experience by reviewing tax returns prepared, providing preparers with constructive feedback and guidance through the tax preparation process,” Briones said.

Briones says she has worked with VITA in the past and said she enjoys the service she is able to give to the community.

“I highly encourage moderate income taxpayers in the community to take advantage of the excellent tax preparation services that are offered through VITA for free,” Briones said. “I am thankful for the opportunity to work with Dr. O’Shaughnessy, who is very knowledgeable and experienced with tax preparation, and am happy to serve the community through this great cause.”

In order for one to have their taxes prepared by VITA, they would need to provide photo identification, social security card and student ID for identification purposes. In terms of tax information, 2021 W-2s and 1099s forms, bank routing number and bank account number are required as well as a copy of one’s 2020 completed federal and state tax returns, if they are available.

The service also is available to international students if they have their passport, Visa, 1-20, ITN or social security card available as well as their 2021 W-2’s, 1099’s and 1042-s.

The next session will be on Friday, March 4. The following sessions will be on March 11, April 1 and April 8. All sessions are from 11 a.m. to 5 p.m. in Business Building Room 353. More information is available at vita.murraystate.edu.