The pink tax isn’t a federal tax that affects income tax refund, but it is a type of price discrimination that impacts millions of women’s personal finances and lives annually.

The “pink tax” is the concept that women’s products and services tend to be priced higher than men’s, a type of gender-based price discrimination. Over the years, this tax has been coined as the “pink tax” because most manufacturers use the color pink to market and brand products specifically designed for women.

The pink tax doesn’t only apply to period products. Over the years, advocacy organizations have pointed to different examples of the pink tax including pricing discrimination. Examples include:

- Higher cost and smaller sizes of products like women’s razors, shampoo and deodorant, relative to similar personal hygiene products designed for men.

- Higher prices of toys or equipment marketed to girls, like pink bikes, scooters and helmets, relative to identical red or blue bikes, scooters and helmets.

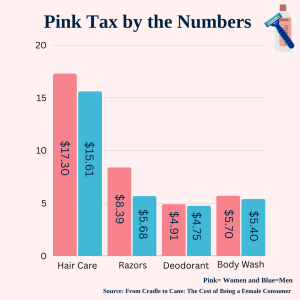

A 2015 study from New York City’s Department of Consumer Affairs, found women pay more for almost every product they purchase over the course of their lives. For the study, the DCA analyzed seven types of personal care products, including hair care (shampoo and conditioner), razors, razor cartridges, lotion, deodorant, body wash and shaving cream.

“On average, personal care products cost women 13% more than men,” the study reported. “In total, one of each average item cost women $57.18, and cost men $50.75, a difference of $6.43.”

The study determined the price differences between products were most often because of differing quantities.

“For example, deodorant was often sold to men in quantities of 2.7-ounce sticks, and women were often sold quantities of 2.6-ounce sticks at the same price,” the study continued. “Similarly, men save at the register by requiring fewer products for the same advertised claims. For example, body washes are often sold “for men” with claims of doing double (or triple) duty as a shampoo and/or conditioner.”

The only beneficiaries of the “pink tax” are the companies that charge women more than men.

Several states have passed laws against discriminatory gender-based pricing of products and services. In 2018, Jackie Speier (D-CA) introduced the Pink Tax Repeal Act. The goal is to regulate seemingly unjust price discrepancies out of existence. The bill failed.

Similar to the pink tax, the “tampon tax” specifically refers to the sales tax on the already-high price of tampons or other menstrual products. Like other period products, tampons are frequently taxed as luxury goods, even though millions of menstruating individuals consider tampons to be necessities.

Kentucky currently taxes these items as “luxuries.” In recent years, there has been a push in the state to remove the sales tax on these items.

The most recent piece of legislation, House Bill 142, introduced by Rep. Lisa Willner (D-Jefferson) last year, aimed to remove the sales tax placed on period products.

Rising costs of period products have also led to an epidemic of “period poverty”— meaning that an estimated one in four women and girls cannot afford menstrual products.

One organization, Period Law, found the tampon tax adds up, with an estimated annual cost to consumers of $80 million. The organization also found 21 states still tax period products, and, as mentioned earlier, Kentucky is one.

The organization launched the Tampon Tax Activation in 2019. This resource is available in 33 states and allows individuals to request a sales tax refund after purchasing period products.

The best way to avoid paying the “tax” is to do some homework and look into the male versions of certain products, like razors. Another option is to create a Facebook group and share product alternatives.

Currently in Kentucky, House Bill 148 was introduced by Rep. Lisa Willner, D-Louisville in January. The bill would eliminate the sales tax on period products and require middle and high schools to make products available for students. The bill is still awaiting a committee assignment.

Individuals wanting to voice their concerns surrounding this topic, can reach out to their state legislators. For Kentucky, individuals can call and leave a message for their representative with the Kentucky Legislative Research Committee by calling 1-800-372-7181.

Students in need of menstrual products can visit the Women’s Center on campus, located C102 Oakley Applied Science. Products are available for a one-time need or for short-term supply due to financial issues.