Story by Ashley Traylor, News Editor

MURRAY, Ky- Changes to the Commonwealth’s underfunded pension system loom over colleges and universities, as these changes would hit their already strained operating budgets.

“The anxiety level on our campus is very high because of the uncertainty,” Jackie Dudley, vice president of finance and administrative services, said. “It’s just unrest and uneasiness for someone that you might look at that is 55 to 60 years old thinking ‘I might be retiring in a few years.’ You’re in a position now to think ‘I don’t even know what I’m going to get in a few years.’”

Gov. Matt Bevin hired PFM consulting group to analyze the state’s retirement plan, and they made recommendations to solve the pension crisis. Gov. Bevin plans to call a special legislative session this month to discuss PFM’s suggestions and reform the plan.

While lawmakers have yet to decide how to reduce the deficit, colleges and universities could be facing an increase in the amount of pension contributions they are currently paying in for faculty and staff.

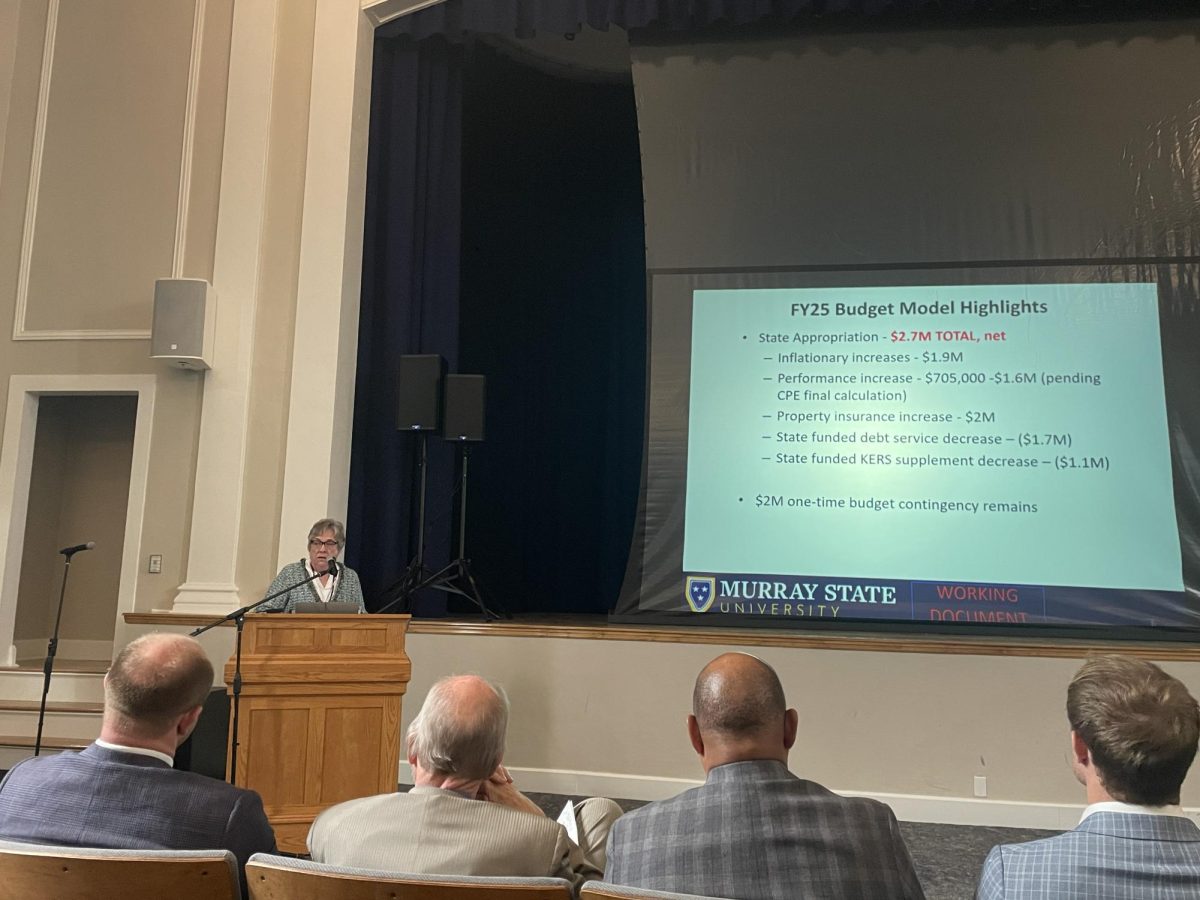

The pension crisis could potentially take revenue away from other campus priorities. Dudley said currently for every dollar an employee makes, Murray State contributes 49.47 cents to the state’s retirement system. She said that number is proposed to increase to 84 cents for every dollar an employee makes.

If that occurs, Dudley said it will cost the university approximately $4.7 million in expenditure that they are not incurring today.

The budget challenges also come at a time when Kentucky public universities have already faced limited budgets and steep cuts to higher education.

The contribution rates have not been approved for the upcoming fiscal year, but doubling the rate will have an impact on Murray State. Dudley said the increased expenditure will impact university decisions on salary raises, priorities the institution funds and tuition rates.

“We can’t increase tuition to that magnitude,” Dudley said. “There’s just absolutely no way. We can’t put funding on the backs of students. You can’t increase it to that magnitude and we won’t, but then you have to find a way to deal with it. That will be program prioritization, and it will be efficiencies we continue to fund and identify. It will be new revenues, and it will be to some degree cuts in operating budgets. This is an overriding issue for us this year.”

Because the pension crisis is consuming revenue that could be spent on campus, Dudley said the state schools gathered to discuss breaking away from the state pension plan.

The model would be similar to the contribution plans at the University of Kentucky and University of Louisville, which do not participate in the state plan but have their own optional retirement plan (ORP).

At the University of Kentucky, employees contribute 5 percent of their base salary to the retirement system, and the university contributes 10 percent of the employee’s base salary, according to their benefits and retirement website.

The University of Louisville has two contribution plans employees can choose from: a 403(b) retirement plan and two 457(b) deferred compensation plans. In the 403(b) plan, the university contributes 7.5 percent of the employee’s base salary and the employee has the option to contribute or not. If the employee makes additional contributions to the retirement plan, the university will match up to 2.5 percent.

The deferred compensation plan, 457(b), allows employees the option to defer compensation on a pre-tax basis through payroll deduction.

If Murray State broke away from the state pension system, the university would have a school-operated defined contribution program, where an employee contributes a percentage of their base salary and the employer would contribute a flat rate.

Dudley said new hires would not have the option to participate in the state pension plan, only the university’s defined contribution program. Current university employees who are under the state’s retirement plans would not be able to opt out of those programs for the school-operated plan.

Murray State has two pension systems: Kentucky Education Retirement System (KERS) and Kentucky Teacher Retirement System (KTRS). All faculty at Murray State fall under KTRS. A faculty member then has the choice between a defined benefit plan or a defined contribution plan.

Faculty under the KTRS plan can choose a defined benefit plan, or an optional retirement plan. For a defined benefit plan, an employee and an employer make contributions to the retirement system, and when the employee retires, he or she receives the same payment for life.

In contrast, an ORP means they will not join the state system. An ORP is a defined contribution plan and the employee could set up their own ‘tax shelter’ or 401K plan. For a defined contribution plan, an employee and an employer make a contribution and that is invested in the market.

Right now under the ORP option, Murray State is contributing 8.74 percent of an employee’s salary to their defined contribution plan. If the university were to elect a school-operated plan, it could avoid the 84 percent contribution rate that is proposed by PFM for the state-funded program.

The contribution rate is legislatively set at 8.74 percent currently, but Dudley said there is the possibility that schools will be able to adjust the rate if they move to a school-operated program.

For years, the state has not appropriated and invested money into the pension for it to remain fully funded, resulting in the state having only 37.4 percent of the money to pay retirees.

“That’s one of the contributing factors that we had that we’re having to pay the price for now because prior legislation decisions were made,” Dudley said. “It’s going to be a tough year.”