Students use student loans to fund their Spring Break

Story by Lindsey Coleman, Staff writer

With Spring Break trips in the rear-view mirror, many students may be searching their wallets, wondering how their money fell into a hole while vacationing with college friends.

The results of a recent survey of 500 college students suggested some students could be turning to their student loans to pay for their excursions.

LendEdu, an online lending and information resource, conducted the study and concluded about 31 percent of polled college students will be using loan money to fund their Spring Break trips. Roughly 24 percent reported they have used loan money to buy alcohol, and around 33 percent said they use loan money to pay for clothing and other accessories.

Respondents had outstanding student loan debt and were planning Spring Break trips. However, in a Twitter poll by The Murray State News, the numbers were lower. Of the 139 students polled, 12 percent said they used loan money to fund their Spring Break vacations, 53 percent said they did not and 35 percent didn’t have loans.

LendEdu estimates 60 percent of all college students will be in loan debt by graduation.

For Grant Knox, senior from Lexington, Kentucky, his student loans are a daily necessity.

“I take about 19 or 20 credit hours every semester and have a lot of responsibilities after normal class hours, so it makes it nearly impossible for me to get a job with consistent hours,” Knox said.

While Knox said he didn’t use loan money for Spring Break, he said he uses his refund check for just about everything – rent, phone bills, food, pet care and car maintenance.

Going “full pedal to the metal” in college is a way for him to make sure graduate school is completely paid for through scholarships. He said any extra income will go toward paying back his undergraduate loans.

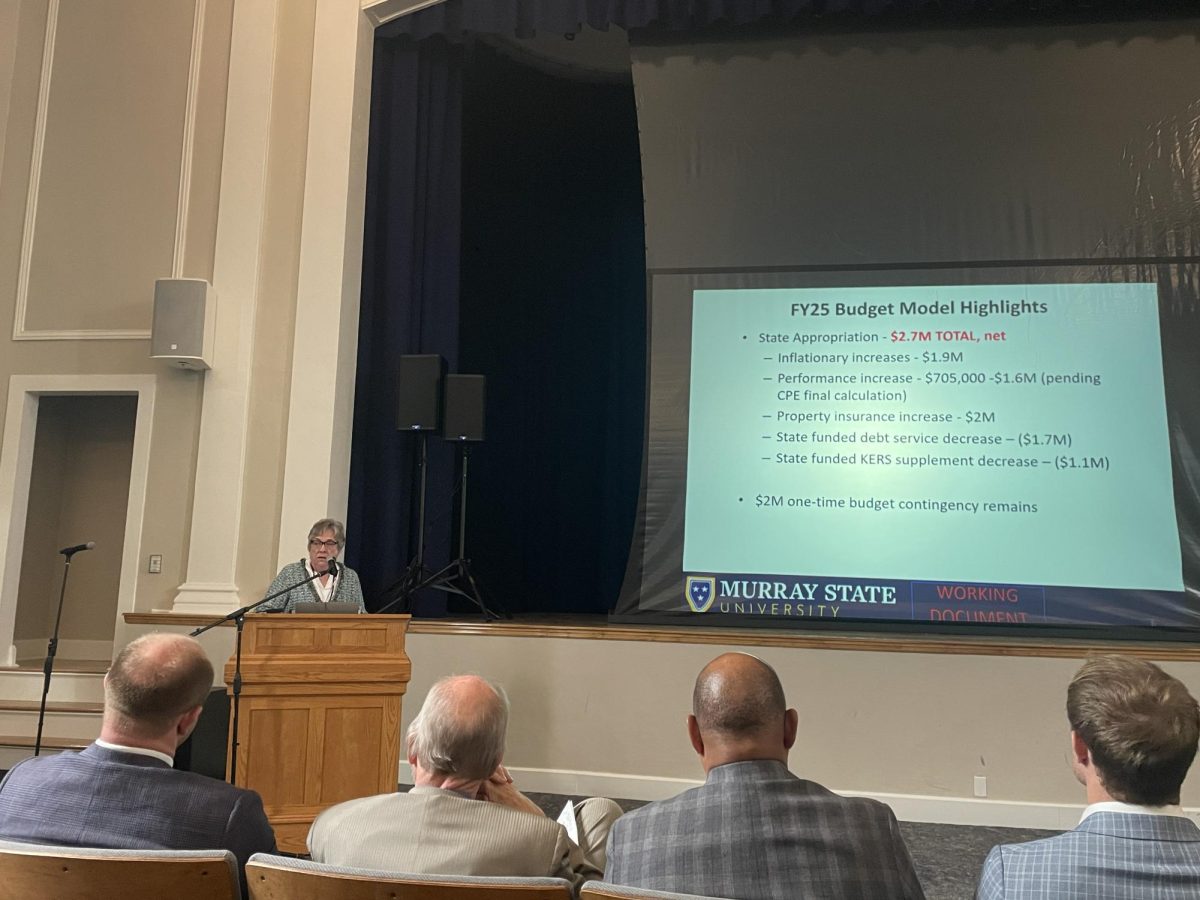

Janet Balok, director of financial aid, said 54 percent of Murray State undergraduate students have federal loans.

Through the Financial Aid Office, each student with loans is encouraged to have a financial planning meeting, during which Balok said students are advised to make wise monetary decisions.

Balok said refund checks, which are often used for daily expenses, must be paid back, as well.

Even though the Financial Aid Office strives to give good advice, Balok said it’s a student’s responsibility to make smart financial choices, even on Spring Break.