Story by Ashley Traylor, Contributing writer

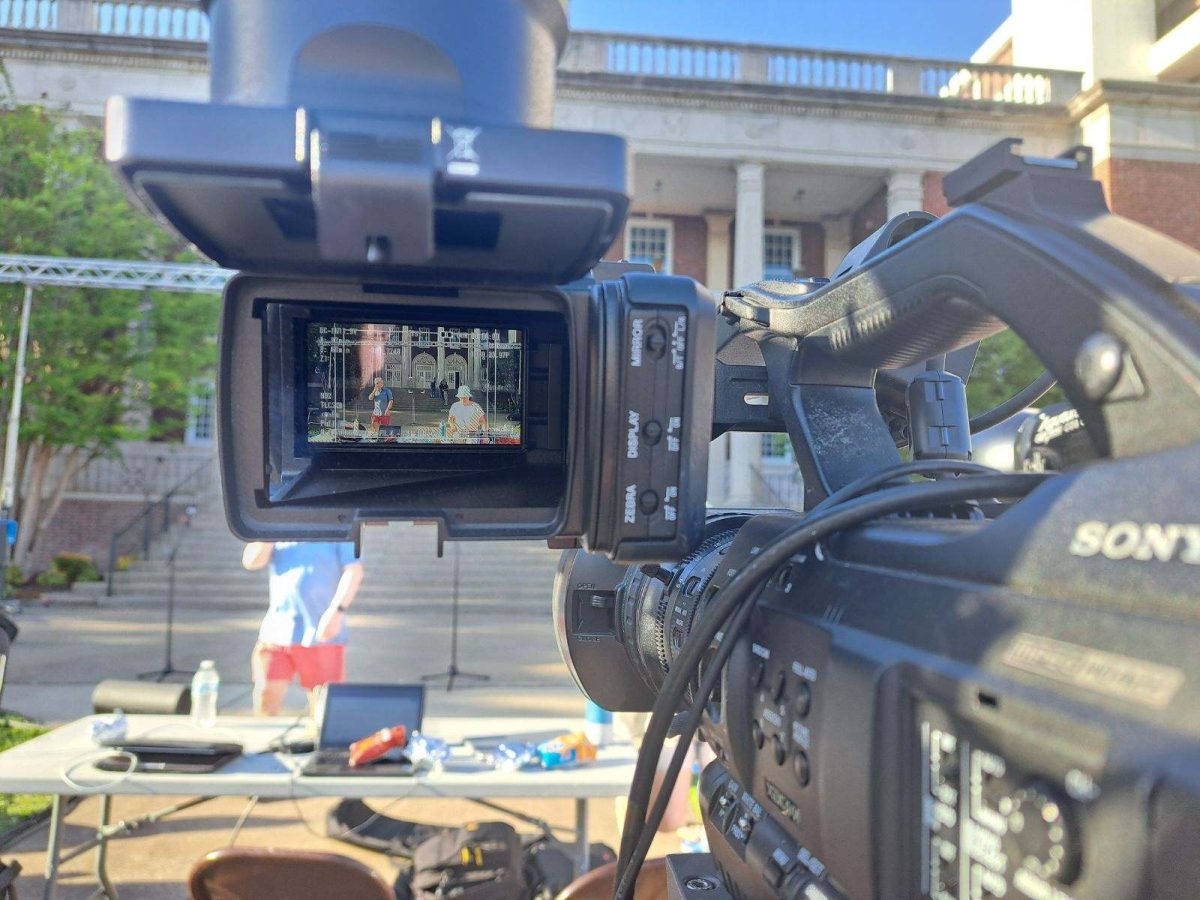

Kristian Hoybye, freshman from Denmark, uses an ATM in the Curris Center.

Jessica Payne, freshman from Owensboro, Kentucky, said she is ready for college tasks, but is less certain of financial responsibility.

“I think I handle my money well, but I do not feel financially stable. I would like to try to budget my money by setting out a certain amount of money for entertainment, groceries, etc.,” said Payne, freshmen from Owensboro, Kentucky.

Payne is not the only freshman who does not feel financially stable.

HigherOne, a business offering financial services to college students, and EverFi, a digital learning company, surveyed 43,000 students about financial readiness earlier this year.

About 91 percent of respondents were freshmen at four-year institutions, but only 58 percent felt ready to manage money.

Students feel more prepared to keep up with coursework, stay organized, find help when needed and manage time wisely, according to the survey.

About 64 percent of students set goals to effectively budget their money in the future, but the percentage of freshmen willingly to budget their money has been declining.

Students graduate with more debt than ever before, largely because of rising tuition rates.

About 71 percent of students are graduating from four-year universities with debt, according to the HigherOne and EverFi survey.

However, those students who get a dose of financial literacy in high school say they feel more prepared to handle their money.

About 40 percent of students surveyed said they had such a class coming to college.

Don Robertson, vice president of Student Affairs, said Murray State offers financial readiness courses. Robertson said Christian Cruce, director of scholarships, teaches a seminar on financial preparedness.

Erika Brunson, senior from Benton, Kentucky, said she recommends freshmen use cash instead of credit card because it is easier to keep track of how much is being spent.

“Also, I suggest having a rainy day fund you always contribute to, so in the event of an emergency your budget won’t be severely affected,” she said.

Thirty-two percent of students have credit cards, according to the HigherOne and EverFi survey.

Mark Jones, freshman from Sikeston, Missouri, said he has a credit card but he would not encourage it.

“It is easy to ruin your credit when you cannot pay back the money you spent,” he said.

Jones is among the majority of college students who have checking accounts.

“When my checking account becomes low, I have it set up to send the remaining balance to my phone,” Jones said. “This way I always know how much I’m spending and when my account is low.”