The staff editorial is the majority opinion of The Murray State News Editorial Board.

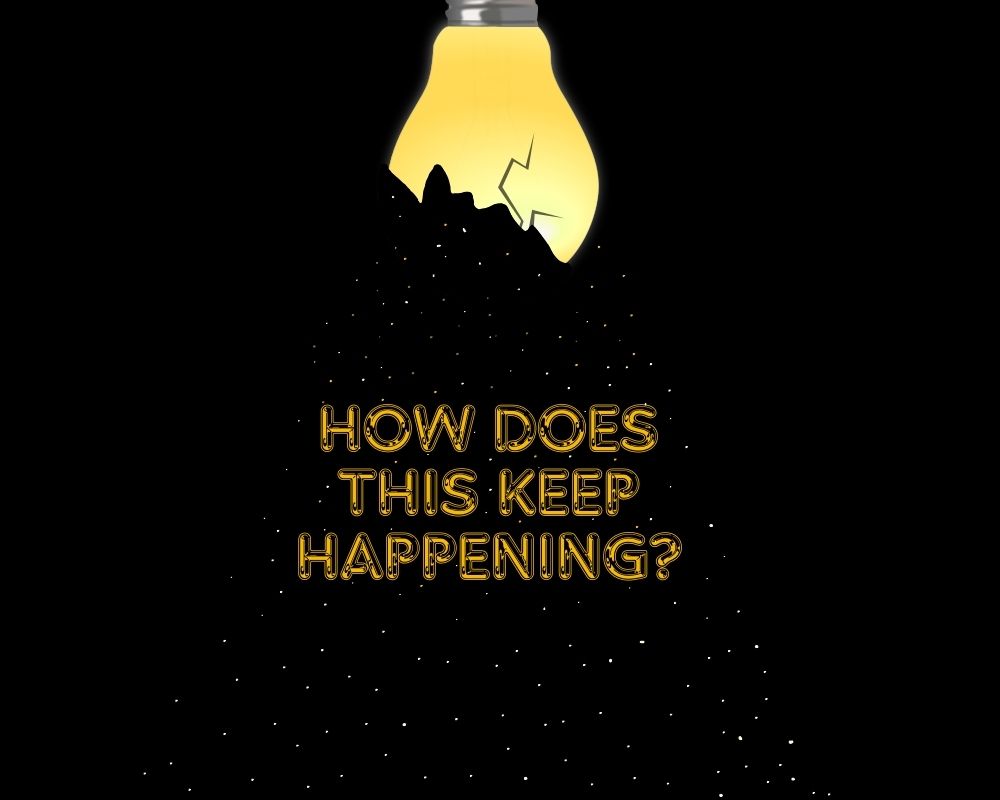

A full house at the CFSB Center usually means fun and fandom, but that wasn’t the case in January 2014, when many on-campus students were herded into the basketball stadium. After the residential halls lost electricity, the stadium was the only refuge for heat to combat the sub-zero temperatures.

The rest of the month was filled with blackouts on other parts of campus, generator malfunctions and pipelines frozen to the point of bursting. While it seemed like a freak accident, all of this could have been prevented if it wasn’t for Murray State’s standing contract with Tennessee Valley Authority.

According to the contract, TVA can shut off electricity whenever the service region exceeds certain power levels. The stipulation means no power, heat or running water, which damaged 40 percent of campus facilities. Now, the University must decide if the same contract is worth signing again by August this year. Is the discount worth losing power with little warning?

Murray State’s former vice president of Finances and Administrative Services, Tom Denton, signed the contract in 2010 in order to receive a discount on electricity costs. The contract was not viewed by the Board of Regents at the time. The contract, now in its final year, outlines the conditions of a 5 MR, or 5 minute response, agreement, stating that zero kilowatts of Murray State’s power is considered protected.

The University has received cumulative credits of $1.3 million since the contract was signed. These credits were used to purchase new generators in the events of a power outage, but they malfunctioned in January.

The University must consider if $1.3 million is worth compromising on-campus students, who provide Murray State with millions more to live in its residential halls. If Murray State requires first and second year students to live on campus, they should be guaranteed the most positive experience possible. This means not huddling for warmth and being crammed into a basketball stadium.

However, the decision to take the discount and resign the contract is attractive in its own ways. Since the power outage in 2014, funding for the University has decreased by more than 20 percent, so saving will likely be a priority. While the decision seems easy when $1.3 million is in the paperwork, the University must consider how much more it could cost if a power outage of the same intensity were to happen again.

TVA has its share of negative relationships. According to the Insider Journal, the Tennessee Environmental Agency sued TVA over its coal-burning power plant in Gallatin County. The lawsuit claims the company disposed of its coal ash in unlined storage ponds, which leaked contaminants into local water supplies. It was also responsible for the largest coal ash disaster in 2008 when a containment dike burst, releasing five million cubic yards of coal ash sludge into the Emery and Clinch Rivers.

Contracting with a more environmentally friendly company with green energy could possibly save more money than a TVA discount could.

The risks and rewards should require consideration from the Board of Regents. The Regents should take the time and plan the best decision to make, but they should also keep in mind that cutting corners can come with consequences.