A student reads brochures on how to take out loans, the different loans available, receiving scholarships and grants and how to pay for college.

(WITH VIDEO) – The college experience is arguably some of the best years of a person’s life, filled with friends, parties, networking and learning.

But following four years of fun, student loans bear down at around $20,000 an average estimate for a Murray State graduate.

For some students, a student loan of several thousand dollars a year is the only way to afford college and graduate with a degree. And the amount of student debts has only increased.

According to the Department of Education survey of 2008-09 graduates, nearly two-thirds of Bachelor’s recipients borrowed money, where as about 45 percent of 1992-93 graduates borrowed money.

American college students and graduates owe a collective one trillion dollars in outstanding federal loans. Only mortgages account for more personal debt in the U.S.

STUDENTS WITH LOANS

Joilyn Haught, freshman from Owensboro, Ky., has two student loans in order for her to attend college.

“I had to take out one loan for $1,000 and another for $1,750 because I applied for financial aid late and I couldn’t get enough money to use for my schooling,” Haught said.

She said the thought of the loans she has is overwhelming and while she has just begun her college career, she said it has added pressure to do better academically.

“I try not to think about it, but it’s always in the back of my mind that I will have to pay for it, and that’s not coming out of my head,” Haught said.

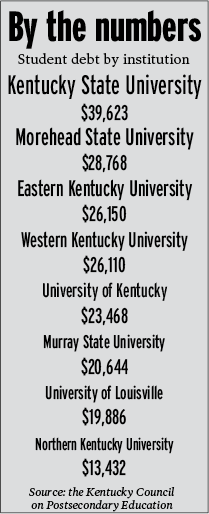

Haught is one of many at Murray State with loans, with 47 percent of Murray State graduates having average debt of $20,644, according to the Kentucky Council on Postsecondary Education.

Murray State ranks sixth on a list detailing the average debt of graduates of the eight public Kentucky universities, according to the report.

The highest average debt is Kentucky State University at $39,623 and the lowest is Northern Kentucky University at $13,432.

Brett Mayberry, junior from Mount Carmel, Ill., has student loans along with a Parent PLUS loan.

A Parent PLUS loan is used to cover additional costs beyond subsidized and unsubsidized loans.

A separate application is used to receive the Parent PLUS loan and requires good credit history, citizenship and other loans in good standing along with other general requirements.

Mayberry said the repaying of loans is different for each person post-graduation because salaries and employment vary.

He said the struggle some student face is choosing a well-paying career over a career they have a strong interest in.

“It depends really on what your major is,” he said. “If you get a job that pays very well, obviously you’re going to pay off your student loans pretty quick. But, if you’re majoring in something that doesn’t pay very well but it’s what you like to do, it’s going to be a while before you pay those off.”

He said he wasn’t surprised student loan debt is more than one trillion dollars, simply because college is just expensive to attend.

STUDENTS WITHOUT LOANS

Alexa Allen, sophomore from Scottsville, Ky., does not have student loans, but sympathizes with those who do because she sees the effect student loans and debts can have on others.

“I think (loans) prevent a lot of students from going to the school they want to go to,” Allen said. “Or, if they don’t get scholarships, they might not go to school at all.”

Allen said she can afford college through scholarships and the Kentucky Education Excellence Scholarship, or KEES, money.

She said she believes college has become increasingly popular and necessary, and student loans are essential for those who otherwise would not be able to afford higher education.

Jaclyn Whoberry, freshman from Louisville, Ky., said she has seen that situation play out with a friend.

She said her friend is attending a more affordable school to lessen the financial burden but is missing aspects of the university experience.

“A friend of mine is at a community college so she can pay for college and she’s kind of missed out on the college life because of it,” Whoberry said.

She thinks student loans can be difficult, but it is not unrealistic.

“You can always get help, you just have to want it that bad and then pay it off,” she said. “It’s definitely not ideal, but it’s necessary.”

HOW MURRAY STATE CAN HELP

Jay Morgan, provost and vice president of Academic Affairs, said there are multiple ways the University can help students with loan debt.

Between classes, educational seminars and lowering credit hours, he said Murray State has been able to maintain fairly low student debt.

He said there are personal finance and financial management classes students can enroll in.

Also, the Financial Aid Office offers seminars to explain to students the difference between various loans, along with what they do and don’t have to pay back.

Morgan said an important aspect in student loans includes the amount of credit hours students take and how many years they stay at Murray State.

“One thing we’re working on at Murray is we’re trying to lower the credits to degree that students are taking,” Morgan said. “I don’t mean the 120. Students are graduating with an average of 142 credits, all students across the board. We’re trying to bring that down to 134 or 135 and have got it down to 139. Each time we get it down we’re going to save students money long term because students are getting out on, on average, quicker.”

However, with loans or not, Morgan said having a college degree is worth it.

“A college education is still a good investment even if you have to borrow money to get through school,” Morgan said. “There are a number of unsubsidized and subsidized loans that students can get to get through and it still far outweighs, for the most part, people who don’t get a college education.”

Story by Mary Bradley, Assistant News Editor, and Ben Manhanke, Staff writer. Video produced by Cameron Witte.