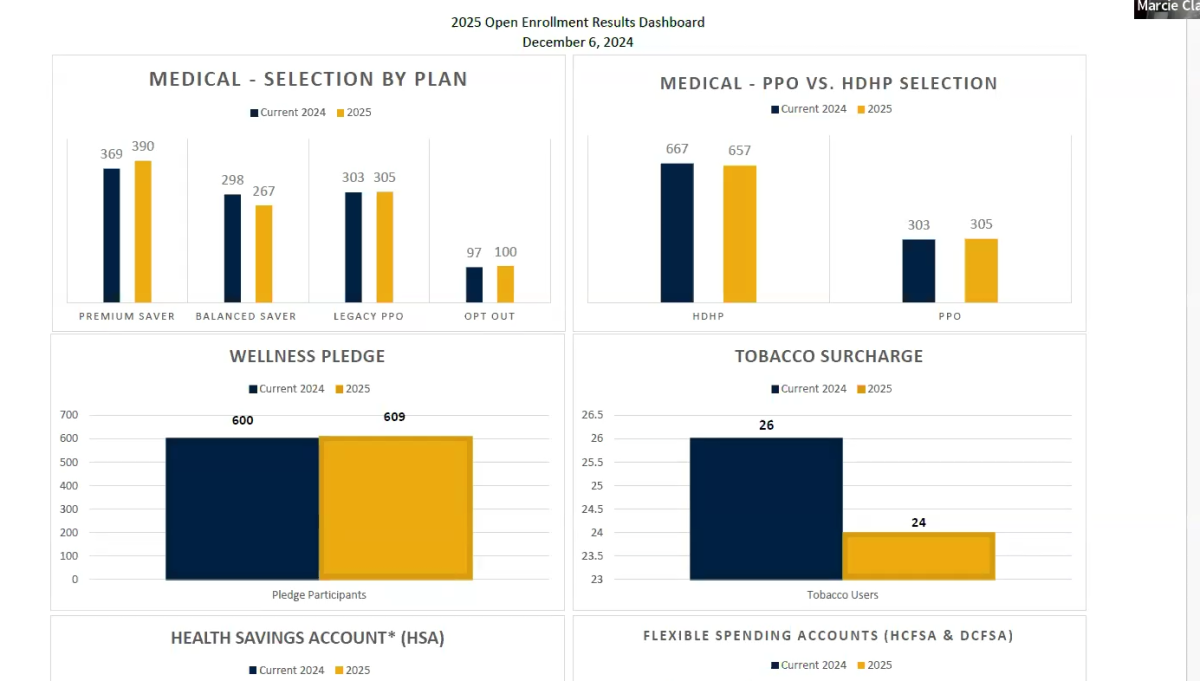

The Insurance & Benefits Committee found a decrease in net medical claims as they met to discuss the results from the 2025 online open enrollment for benefits. The Committee also found employees were choosing a cheaper medical plan, with a few even opting out of a plan altogether.

The Committee observed this from the selection of Premium Saver, the cheapest of the plans, over Balanced Saver. Premium rose from 369 employees to 390, while Balanced Saver dropped from 298 employees to 267. Selection in the most expensive plan, Legacy Preferred Provider plan (PPO), only rose from 303 employees to 305, and those who chose no medical plan increased from 97 to 100.

The Committee also saw increases in employees choosing the Wellness Pledge, a commitment to improve well-being involving screenings and courses in health, rising from 600 to 609. More employees chose the dental plans, Core increasing from 476 to 485 and Buy-Up increasing from 231 to 239. Vision plan selection increased from 591 employees to 612.

There was also a marked drop in tobacco surcharge from 26 employees to 24.

Marcie Clark, assistant director of benefits of Human Resources, said this trend for 2024 is better than the years prior, and reported a decrease in net medical claims. Clark also said there was a decrease in inpatient and outpatient costs.

“It’s good to see where that usage is, falling into the low expense categories,” she said. ”We’ve just had so many tough years that we’re so glad to see that.”

“This is a positive year right here for sure,” Courtney Hixon, director of Human Resources, said. Hixon also said these positive trends in the enrollment are going to help with renewals in the following next year.

”We’re keeping our fingers crossed,” Hixon said.

The Insurance & Benefits Committee is scheduled to meet again on Jan. 31, 2025.