Cady Stribling

News Editor

cstribling1@murraystate.edu

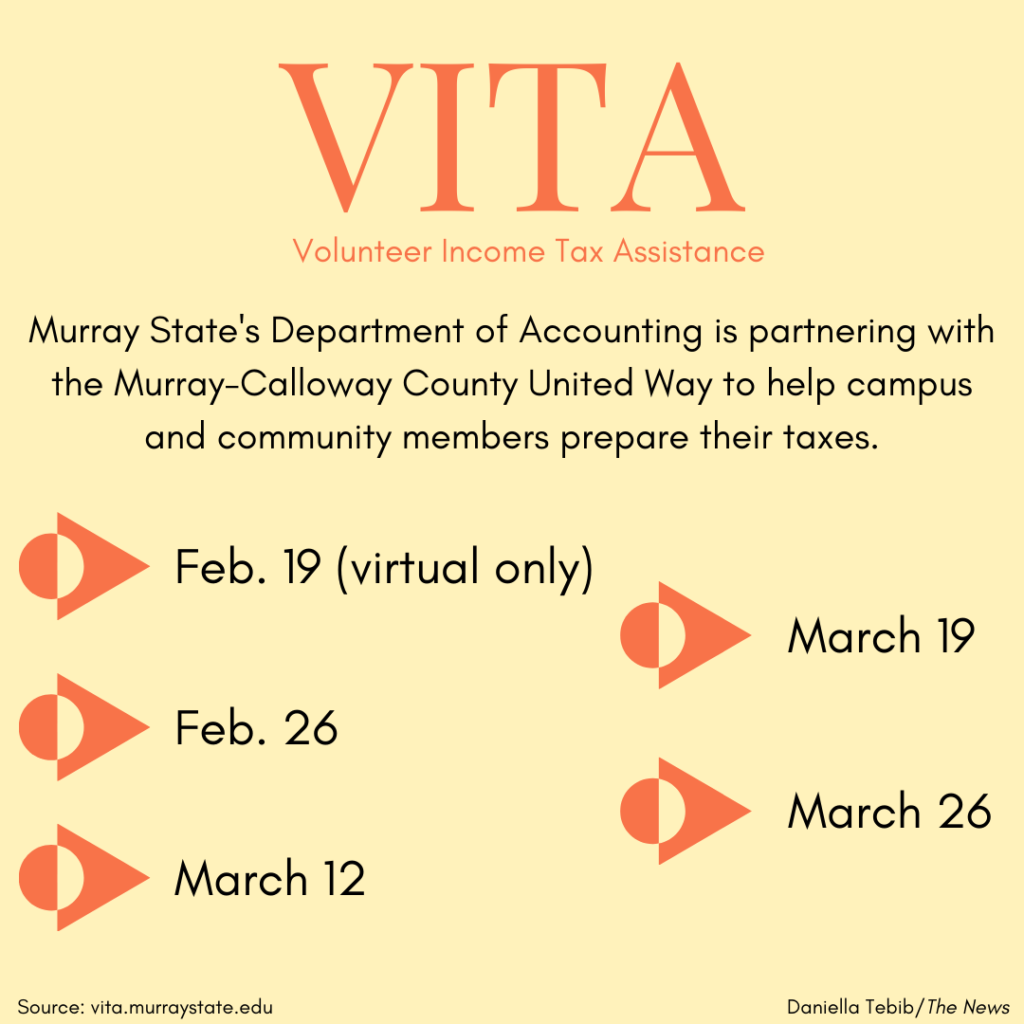

The Department of Accounting is hosting its annual Volunteer Income Tax Assistance program as a virtual site beginning on Friday, Feb. 19.

According to the Murray State VITA program website, free services will be provided for state and federal tax preparation and e-filing for low to moderate income levels in the Murray community.

Partnering with the United Way of Murray-Calloway County, Murray State offers this program during the annual tax filing season each spring to Murray State students, faculty and staff, including international students. Within the community, low to moderate income individuals, families and retired and elderly taxpayers are encouraged to participate, according to the VITA program website.

Murray State students who are accounting majors will directly assist with the program, gaining hands on experience.

“Tax returns are prepared by student volunteers who have attended training and passed required tax law certifications from the IRS,” according to the website. “The site director and site coordinators oversee and assist volunteers through each step of tax return preparation and filing.”

Because of pandemic restrictions, clients typically have two options to file taxes with Murray State this season. There will only be an online option for the Feb. 19 session because of the weather, according to an email sent by the University.

For the online option, clients must complete an application and submit relevant documentation on the Murray State VITA program website under the “Clients” tab. Online applications are accepted Monday through Thursday before the respective VITA session, according to the website.

Available after Feb. 19, the second option requires participants to drop off the required documentation at the Murray State Business Building South in room BB353, which is located on the third floor. Drop off is between 10:15 a.m. to 1 p.m. during one of the Friday sessions, according to the website.

After submitting required tax documents through one of the two options, volunteers will prepare tax returns during the Friday sessions.

“Your application will be assigned based on the order received,” according to the website. “Once received documents will be reviewed by your assigned volunteers, you will be contacted by phone or email regarding any possible questions or additional needed documents. Once all questions are answered and needed documents received, your tax return will be prepared during the five Friday sessions by our trained volunteers and then reviewed by a site coordinator.

There are five Friday sessions being offered for the 2021 season: February 19, February 26, March 12, March 19 and March 26.

Visit the VITA program website for more detailed information.