Austin Ramsey

News Editor

University Human Resources will formally announce changes to the insurance and benefits package later today – a week before open enrollment packets are issued to faculty and staff for 2012.

Among the adjustments is the extended family dependent benefits package, which includes domestic partners, President Randy Dunn announced at the State of the University Address Oct. 5.

The University’s Committee on Insurance and Benefits began evaluating the benefits package a little more than a year ago, following Kevin Binfield’s proposal to the Faculty Senate.

Binfield, professor of English, submitted the proposal to the Senate, which voted to allow the Committee time to review and confirm or deny the resolution.

Ann Beck, committee chair, told The News last fall that a policy change of this nature was necessary because of regional pressures.

“This would allow us to stay competitive with our sister schools,” she said of the Committee’s sitting proposal. “This will be a part of the constant evaluation we have to keep recruiting high quality staff and faculty for Murray State.”

Murray State is the second to last public university in the state – behind Morehead State University – in implementing such a program.

Peggy Pittman-Munke, Faculty Senate president, said the insurance benefits package aimed at domestic partners is in good timing because of the recently passed Diversity Plan.

Dunn’s proposal was given directly to his administration, bypassing the Board of Regents, because the president is authorized to make changes to health insurance and wellness plans annually, Josh Jacobs, the president’s chief of staff, said via email.

“We’ve had a goal of trying to have this in place by our new calendar year,” Dunn said.

The package extends health and other insurance benefits to families with non-married couples as long as the claimed dependent meets University requirements.

Those requirements are almost identical to those of Northern Kentucky University. They include an affidavit form, along with any legal or contractual documents Murray State may request in order to prove the dependency of the partner or child an employee claims.

Jody Cofer, co-chair of the President’s Commission on Diversity and Inclusion, said these requirements are not abnormal.

“Because there is not the legal institution of marriage for some of these people, we have to qualify it in some way,” Cofer said. “To do that, these parameters have been established. It’s working at other institutions, and it can work here for us.”

Employees will be responsible for paying the full cost of the coverage of the extended family dependent, as federal law mandates that no public money can be used to cover those benefits.

Tom Hoffacker, director of Human Resources, said the University administration took the recommendation from the Committee on Insurance and Benefits and used its data to conduct a survey on the fiscal impact of extended family benefits.

“The cost to add extended family members to other benefits including tuition waivers, dental insurance, access to the Bauernfeind Wellness Center, Dining Services family discounts and time-off programs … will be around $54,000,” he said. “The low estimate of costs is $36,000 and high estimate is $72,000.”

According to administration, premiums will increase the normal 4.8 percent.

Hoffacker said the open enrollment packets will also include a new vision plan. But the University is trying to sort out the differences found in similar or overlapping benefits, he said.

“In our medical plan there are some vision plan benefits,” he said “You would think they would be completely different. To make things even more odd, in our dental plan, we have a minor vision care benefit.”

Hoffacker also said there will be an optional investment vehicle available to employees who want to make use of tax advantages related to pretax income.

The Supplemental 403B Plan is one of nearly nine tax investment programs the University offers. Hoffacker said he hopes it will encourage employees to save for the future.

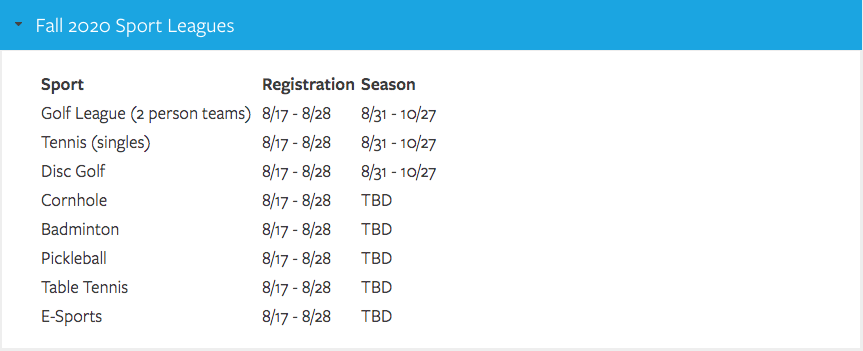

Open enrollment period begins Monday and lasts through Oct. 28.

How to identify an extended family dependent

-Age 18 or older and mentally competent to consent

-Either not related by blood to the employee or if a blood relative (or relative by adoption or marriage) is of the same or younger generation of the employee

-Not legally married to anyone

-Not currently eligible for any part of Medicare

-Residing in the employee’s household and have done so for a period of at least 12 months

-Financially interdependent (for example, have joint checking account or joint mortgage) for 12 months or longer

Contact Ramsey